Operating leases, contingent liabilities, and joint venture accounts are excluded from the balance sheet.

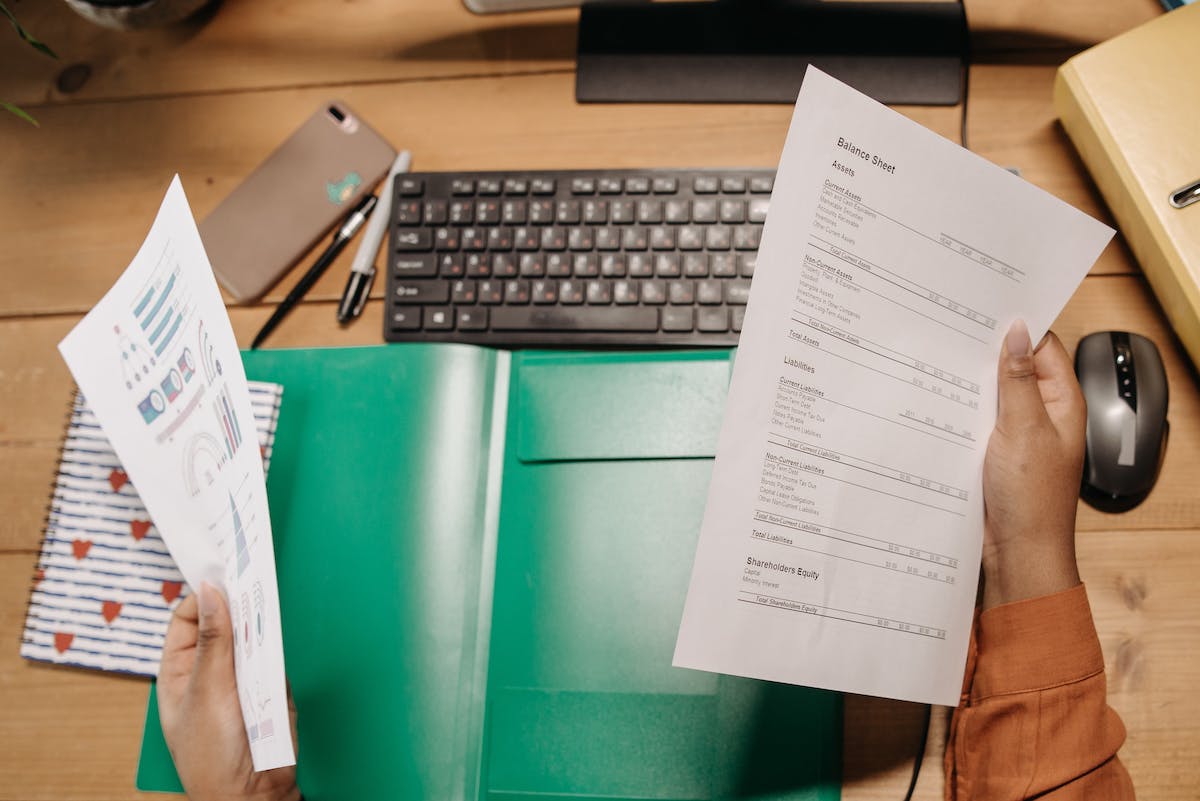

Ever wondered what goes on behind the scenes in a company’s financial records? The balance sheet, a key player in the financial statement game, often takes center stage. But here’s the twist – not all accounts make it to this stage. Let’s uncover the mystery of the accounts that prefer to stay incognito.

Here’s a table listing down various accounts that do not appear on the balance sheet, along with their types, reasons for not appearing, and the pros and cons associated with each:

| Account Type | Reason for Exclusion from Balance Sheet | Pros | Cons |

|---|---|---|---|

| Operating Leases | Leases are treated as off-balance sheet to maintain liquidity. | – Enhances liquidity perception. | – Potential long-term obligations are hidden. |

| Contingent Liabilities | Uncertain events, like lawsuits, may not materialize. | – Immediate financial impact is not reflected. | – Can lead to unexpected financial burdens. |

| Joint Ventures | Shared projects with other entities. | – Opens doors to collaborative opportunities. | – Risks and rewards are not directly visible on the balance sheet. |

Please note that the table is a concise overview, and each category can have more nuanced details. It’s always essential for investors and analysts to delve deeper into footnotes and disclosures for a comprehensive understanding of a company’s financial landscape.

Off-Balance Sheet Accounts – The Elusive Players:

While the balance sheet paints a vivid picture of a company’s financial health, it doesn’t tell the whole story. Enter the world of off-balance sheet accounts. These sneaky financial actors prefer to stay out of the limelight, yet their impact is substantial.

Types of Off-Balance Sheet Accounts:

- Operating Leases: A company renting its office space or equipment. The lease payments for these assets may not find a spot on the balance sheet, but they certainly affect the company’s cash flow.

- Contingent Liabilities: Ever heard of those “what-ifs”? Contingent liabilities are like those unpredictable plot twists. They include potential lawsuits or warranty claims that might not be on the balance sheet but could shake things up if they materialize.

- Joint Ventures: Companies often team up for projects. The financial commitment to joint ventures might not show up on the balance sheet, but the risks and rewards play a crucial role behind the scenes.

Recording Off-Balance Sheet Accounts:

So, how do companies keep track of these off-balance sheet shenanigans? Well, it’s all about footnotes and disclosures. In the financial statement footnotes, companies spill the beans about these hidden accounts, providing readers with a backstage pass to the financial show.

Impact On Financial Statements:

Off-balance sheet accounts may not be in the spotlight, but they can cast a shadow on financial statements. Investors and analysts need to be Sherlock Holmes, digging into footnotes to uncover potential risks and future obligations that could impact the company’s performance.

- Enhanced Liquidity: Operating leases, for example, may keep debts off the balance sheet, making a company appear more liquid than it actually is. Investors need to read between the lines to understand the full financial picture.

- Risk Assessment: Contingent liabilities can be like ticking time bombs. While not reflected on the balance sheet, they could explode, affecting a company’s financial stability. Investors need to be aware of these potential threats.

- Hidden Opportunities: Joint ventures might not be front and center, but they could be the key to unlocking hidden opportunities. Understanding off-balance sheet arrangements allows investors to see the full spectrum of a company’s ventures.

Legality for Off-Balance Sheet Financing

Off-balance sheet financing involves legal considerations primarily related to disclosure requirements and accounting standards. Companies must adhere to regulatory frameworks, ensuring transparent reporting of off-balance sheet items like operating leases and contingent liabilities. Compliance with laws such as the Sarbanes-Oxley Act is essential, emphasizing accurate financial disclosures to protect investor interests and maintain credibility in financial markets.

Real Life Example To Understand Off-Balance Sheet

Let’s consider a fictional company, XYZ Inc., to illustrate real-life examples of off-balance sheet financing:

- Operating Leases:

- Scenario: XYZ Inc. decides to lease a state-of-the-art production facility instead of purchasing it outright.

- Explanation: By entering into an operating lease, the company can keep the lease liabilities off the balance sheet, showcasing a healthier financial picture. However, they are committed to making lease payments over the lease term.

- Contingent Liabilities:

- Scenario: XYZ Inc. faces a product recall due to unforeseen quality issues, potentially leading to legal claims.

- Explanation: The potential legal claims and costs associated with the product recall may not be immediately recorded on the balance sheet. This contingent liability remains hidden until the actual legal actions materialize.

- Joint Ventures:

- Scenario: XYZ Inc. forms a joint venture with another company to develop a new product line.

- Explanation: While the joint venture’s financials are not consolidated on XYZ Inc.’s balance sheet, the risks and rewards of this collaborative effort are shared. The profitability or losses from the joint venture are reported separately, allowing XYZ Inc. to maintain financial flexibility.

Understanding these scenarios helps investors and analysts recognize that a company’s financial health extends beyond what’s visible on the balance sheet, emphasizing the importance of delving into footnotes and disclosures for a comprehensive assessment.

References Off-Balance Sheet Financing

For further study on legal aspects of off-balance sheet financing, you may find the following types of websites helpful:

- U.S. Securities and Exchange Commission (SEC):

- Website: SEC

- The SEC provides regulatory guidance and disclosure requirements for companies, including those related to off-balance sheet financing.

- Financial Accounting Standards Board (FASB):

- Website: FASB

- FASB sets accounting standards in the United States. Checking their publications can provide insights into accounting principles, including those related to off-balance sheet items.

- National Association of Certified Valuators and Analysts (NACVA):

- Website: NACVA

- NACVA may offer resources and insights into valuation and analysis, which can be relevant when considering off-balance sheet financing.

- American Institute of Certified Public Accountants (AICPA):

- Website: AICPA

- AICPA provides standards and guidance for the accounting profession, including information on financial reporting.

- Legal Information Institute – Cornell Law School:

- Website: LII – Cornell Law School

- For legal aspects, LII offers a comprehensive resource for U.S. legal information.

Remember to cross-reference information and consult authoritative sources to ensure accuracy and up-to-date information in legal and financial matters.

FAQs on Accounts Appearing on the Balance Sheet

Q1: Which account does not appear on the balance sheet according to Quizlet?

Quizlet doesn’t specifically list accounts but generally, off-balance sheet accounts like operating leases and contingent liabilities may not appear on the balance sheet.

Q2: What is not reported in the balance sheet?

Off-balance sheet items such as operating leases and contingent liabilities are not directly reported on the balance sheet, contributing to a more comprehensive understanding of a company’s financial health.

Q3: Which account does appear on the balance sheet?

Accounts that typically appear on the balance sheet include assets (such as cash, inventory, and property), liabilities (like loans and accounts payable), and equity.

Q4: What accounts appear on the balance sheet according to Quizlet?

Quizlet may emphasize that assets, liabilities, and equity are the primary accounts that appear on the balance sheet, providing a snapshot of a company’s financial position at a specific point in time.