Have you ever heard someone mention the “FTSE 100 FintechZoom” and wondered what it meant? You’re not alone! This term combines two things: the FTSE 100 and the world of FinTech. But fear not, because we’re here to break it down for you.

Table of Contents

What is the FTSE 100?

The FTSE 100, also known as the “Footsie,” is a stock market index that tracks the performance of the 100 largest companies listed on the London Stock Exchange (LSE) by market capitalization. Here’s a breakdown of its key features:

Focus on Big Players: It represents the biggest and most valuable companies in the UK stock market. Similar to how the S&P 500 tracks major US corporations.

Market Capitalization Matters: Companies are included based on their market capitalization, which is the total value of all their outstanding shares. Think of it as a measure of a company’s size and financial clout.

Dynamic Composition: The FTSE 100 is reviewed quarterly, meaning companies can be added or removed based on their market cap performance. It ensures the index reflects the current landscape of leading UK companies.

Real-time Tracking: The FTSE 100 is calculated and published every second when the market is open, offering a constantly updated snapshot of the performance of these top companies.

Benchmark for Investors: The FTSE 100 is a widely used benchmark for investors to gauge the overall health of the UK stock market and compare the performance of their investments.

What’s the FTSE 100 FintechZoom All About?

The term “FTSE 100 FintechZoom” isn’t actually an official list, but it’s a handy way to imagine the intersection of these two worlds. It basically refers to those leading FinTech companies that are also big enough to be contenders for the FTSE 100. These companies are at the forefront of innovation, using technology to streamline financial services, make them more accessible, and maybe even a little cooler.

Think Beyond Online Banking: Unveiling the Diverse World of FTSE 100 FintechZoom

The world of the FTSE 100 FintechZoom is a vibrant ecosystem teeming with innovation. While online banking might be the first thing that comes to mind, these FinTech frontrunners are disrupting the financial landscape in a multitude of ways. Here’s a glimpse into some of the exciting flavors you’ll find within this group:

- Payment Powerhouses: These companies are the rockstars of the digital payment revolution. They’re making it easier, faster, and more secure to send and receive money, both domestically and internationally. Think tap-and-pay solutions, seamless online transactions, and innovative ways to manage your everyday finances on the go.

- Robo-Advisors on the Rise: Forget the intimidating image of a suited financial advisor with hefty fees. Robo-advisors are changing the game by offering automated investment advice powered by algorithms. This makes sophisticated investment strategies more accessible to everyone, not just those with high net worth. Imagine getting personalized investment recommendations without the high cost!

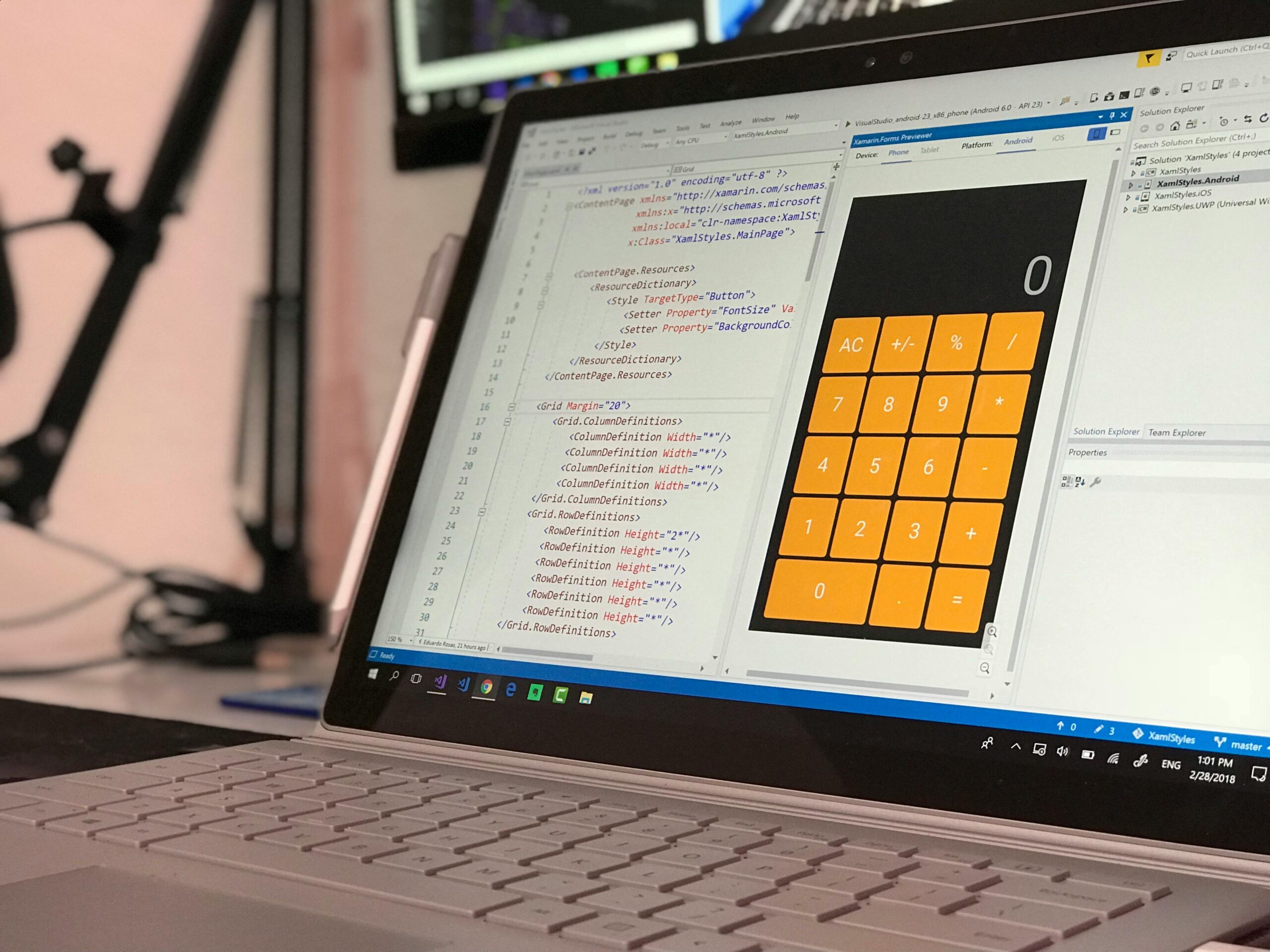

- Blockchain Bonanza: This revolutionary technology is all the buzz, and for good reason. Some of the FTSE 100 FintechZoom players are harnessing the power of blockchain to create secure and transparent systems. This could revolutionize areas like secure transactions, record-keeping, and even supply chain management, making financial processes more efficient and trustworthy.

- Lending a Digital Hand: Traditional loan applications can be a hassle. But some FTSE 100 FintechZoom companies are streamlining the process through online platforms and innovative credit assessment methods. This can make it easier for individuals and small businesses to access the funding they need to grow and thrive.

- InsurTech Innovation: The insurance industry is also feeling the FinTech wave. These companies are leveraging technology to offer personalized insurance plans, streamline claims processes, and even make insurance more affordable. Imagine getting a customized insurance quote in minutes or filing a claim with just a few clicks!

FTSE 100 FinTechZoom: Where Finance Meets Technology and Innovation Takes Center Stage

The financial world is no stranger to tradition, but a new breed of challenger is emerging, and it’s armed with cutting-edge technology. Welcome to the exciting intersection of the FTSE 100 and FinTech, a space we’re calling the FTSE 100 FinTechZoom. Here, the established giants of the UK stock market meet the bold innovators of financial technology, creating a dynamic landscape where the future of finance is being shaped.

The FTSE 100: A League of Market Leaders

Think of the FTSE 100 as the premier league of the London Stock Exchange. It features the 100 biggest and most valuable companies listed there, kind of like the S&P 500 in the US. These companies represent the titans of various industries, their success a testament to their established track record.

FinTech: The Disruptive Force

Now, let’s zoom in on the “FinTech” part. Short for financial technology, FinTech refers to companies that are using technology to revolutionize the way we manage our money. We’re talking mobile payment systems, online investment platforms, and even some mind-bending stuff involving cryptocurrency.

FTSE 100 FinTechZoom: The Powerhouse Intersection

The FTSE 100 FinTechZoom isn’t an official list, but it’s a powerful concept. It represents those leading FinTech companies that have the potential to join the ranks of the FTSE 100 based on their size and impact. These companies are the pioneers, using technology to streamline financial services, make them more accessible, and frankly, a whole lot cooler.

Beyond Online Banking: A Spectrum of FinTech Innovation

The beauty of the FTSE 100 FinTechZoom lies in its diversity. It’s not just about one type of FinTech company; it’s a vibrant ecosystem with a range of specialties:

- Payment Powerhouses: These are the game-changers in the world of digital payments, making sending and receiving money a breeze.

- Robo-Advisors on the Rise: Forget hefty fees, these FinTech players use algorithms to provide personalized investment advice, making it accessible to everyone.

- Blockchain Revolutionaries: This cutting-edge technology is being harnessed by some FTSE 100 FinTechZoom companies to create secure and transparent financial systems.

- Lending a Digital Hand: Streamlined online loan applications and innovative credit assessment methods are changing the borrowing landscape.

- InsurTech Innovators: The insurance industry is getting a makeover with personalized plans, faster claims processes, and potentially more affordable coverage.

Why the FTSE 100 Matters to Investors?

The FTSE 100 holds significant weight for investors interested in the UK stock market and broader economic health. Here’s why it’s such a crucial benchmark:

- Market Pulse: It acts as a heartbeat for the UK stock market. By tracking the performance of the 100 largest companies, the FTSE 100 provides a real-time snapshot of the overall market health. If the FTSE 100 is rising, it generally indicates a positive sentiment and potentially strong economic conditions in the UK. Conversely, a decline might suggest investor caution or economic challenges.

- Investment Benchmark: Many investment funds and portfolios use the FTSE 100 as a benchmark to measure their own performance. Imagine it as a yardstick – investors can compare the returns of their holdings against the performance of the broader market, represented by the FTSE 100. This helps them gauge their investment strategy’s effectiveness.

- Investor Confidence: The FTSE 100 also plays a role in investor confidence. A strong and stable FTSE 100 can boost investor confidence in the UK market, attracting more investment and potentially leading to further growth. Conversely, a volatile or declining FTSE 100 might deter investors, impacting the overall market.

- Understanding Risk and Opportunities: By analyzing the performance of different sectors within the FTSE 100 (e.g., finance, energy, consumer goods), investors can gain insights into potential risks and opportunities. For instance, if the energy sector within the FTSE 100 is experiencing a boom, it might indicate a good time to invest in energy-related companies.

- Global Investment Tool: The FTSE 100 isn’t just relevant for UK investors. Many international investors also use it to gauge the overall health of the UK economy and make informed decisions about investing in UK companies or the broader European market.

What Other FTSE Indices Are There?

The FTSE 100 is definitely a heavyweight in the UK stock market scene, but there are several other FTSE indices that track different segments of the market.

- FTSE 250 Index: This index tracks the performance of the next 250 largest companies listed on the London Stock Exchange after the FTSE 100. It can be a good way to get exposure to mid-sized British companies with growth potential.

- FTSE 350 Index: This is simply the combination of the FTSE 100 and FTSE 250 indices. It provides a broader picture of the UK stock market.

- FTSE All-Share Index: This index takes things a step further by including all the companies listed on the London Stock Exchange, not just the largest ones. It’s the most comprehensive UK stock market index.

- FTSE Small Cap Index: This index focuses on smaller companies listed on the London Stock Exchange, offering exposure to potentially high-growth businesses in their early stages.

- FTSE Fledgling Index: This index tracks an even smaller group of very new companies, perfect for investors looking for high-risk, high-reward opportunities.

There are also FTSE indices focused on specific sectors like real estate or technology, and even those that consider environmental, social, and governance (ESG) factors when selecting companies.

Conclusion:

The FTSE 100 FintechZoom, if it’s a financial service or index focused on Fintech companies, could be a valuable tool for researching potential trust fund investments in this growing tech sector. However, it’s important to remember that specific details about this tool are unavailable.

Before making any investment decisions, conduct your own research and consider consulting with a financial advisor to ensure the FTSE 100 FintechZoom aligns with your overall investment strategy.

References:

- Internal Revenue Service (IRS): https://www.irs.gov/e-file-providers/estates-and-trusts

- Financial Industry Regulatory Authority (FINRA): https://www.finra.org/rules-guidance/guidance/reports/2024-finra-annual-regulatory-oversight-report/trusted-contact-persons

- American Bankers Association (ABA): https://www.aba.com/

- London Stock Exchange Website: https://www.londonstockexchange.com/indices/ftse-100

- FTSE Russell Website: https://www.londonstockexchange.com/indices/ftse-100

- Wikipedia – FTSE 100 Index: https://en.wikipedia.org/wiki/FTSE_100_Index

FAQs

1. How to make money from the FTSE 100?

There are two main ways to profit from the FTSE 100’s performance:

Buying individual shares: You can directly purchase shares of companies within the FTSE 100. If the share price increases, you can potentially sell them for a profit. However, this approach requires research and carries a higher risk as the performance of individual companies can vary.

Investing in FTSE 100 tracker funds: A simpler option is to invest in a tracker fund that replicates the FTSE 100. This means your investment reflects the overall performance of the index. Tracker funds typically offer lower fees compared to actively managed funds.

2. What is the best FTSE 100 tracker fund?

There isn’t a single “best” tracker fund, as each has its own fees, features, and performance history. However, some resources can help you compare different options:

Financial comparison websites: These websites allow you to compare fees, performance, and other factors of various FTSE 100 tracker funds available for US investors.

Investment brokerages: Many online brokers offer FTSE 100 tracker funds and provide research tools to help you choose the one that aligns with your investment goals.

3. How to invest in the FTSE 100 in the US?

US investors can access the FTSE 100 through several avenues:

US-listed ETFs (Exchange Traded Funds): These US-based ETFs track the FTSE 100, allowing you to invest in dollars.

Online brokers: Many US brokers offer access to international markets, including the London Stock Exchange. You can then buy shares of individual FTSE 100 companies or invest in FTSE 100 tracker funds listed on foreign exchanges.

4. Is the FTSE 100 UK companies?

Yes, the FTSE 100 exclusively tracks the performance of the 100 largest companies listed on the London Stock Exchange. These companies can be domestic (UK-based) or international with a primary listing in London.